Welcome to the next installment of our Evidence-Based Investment Insights: Financial Gurus and Other Fantastic Creatures.

In our last piece, “The Siren Song of Daily Market Pricing,” we explored how price-setting occurs in capital markets, and why investors should avoid reacting to breaking news. Today, we will explore the common pitfalls of seeking a "so-called" expert to read the market for you.

In his Berkshire Hathaway 2017 Shareholders Letter, Warren Buffet described his take on investment “experts” when he wrote: “Performance comes, performance goes. Fees never falter.”

Instead, Buffett suggests, “Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with every bit of Wall Street jargon. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals.”

Group Intelligence Wins Again

As we covered in “Group Intelligence and the Market,” large markets made up of many institutions and individuals are better at arriving at accurate answers than any one person or small group. This is in part because their wisdom is already built into market prices.

Thus, even experts who specialize in analyzing business, economic, geopolitical or other market-related information face the same challenges you do if they try to beat the market. For them too, group intelligence remains a prohibitively effective hurdle to overcome.

The Proof is in the Pudding

Can you think of an extraordinary stockbroker or fund manager or TV personality who appears to be among the elite few who can make the leap? Maybe they have a stellar track record, impeccable credentials, a secret sauce or brand-name recognition. Should you turn to them for the latest market tips, instead of settling for “average” returns?

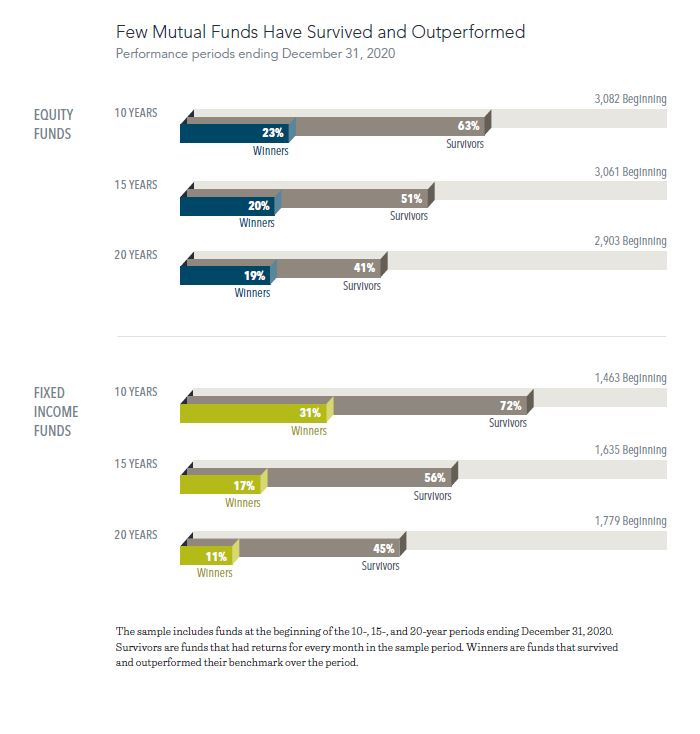

Morningstar publishes a semiannual Active/Passive Barometer report, comparing actively managed funds to their passively managed peers. In the February 2019 report, Morningstar found: “In general, actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons; only 24% of all active funds topped their average passive rival over the 10-year period ended December 2018.”

Dimensional Fund Advisors found similar results in its independent analysis of 10-year mutual fund performance through year-end 2020.

The evidence also dispels the notion that hedge fund managers and similar experts can fare better in their more rarified environments. For example, financial author Larry Swedroe provides an ongoing hedge fund performance update on ETF.com. In April 2019, he reported, “over the 10-year period ending 2018, [hedge funds] underperformed every single major equity asset class by wide margins.” Even for hedge funds, Swedroe suggests “the efficiency of the market, as well as the cost of the effort” are too tough to consistently overcome.

The evidence also dispels the notion that hedge fund managers and similar experts can fare better in their more rarified environments. For example, financial author Larry Swedroe provides an ongoing hedge fund performance update on ETF.com. In April 2019, he reported, “over the 10-year period ending 2018, [hedge funds] underperformed every single major equity asset class by wide margins.” Even for hedge funds, Swedroe suggests “the efficiency of the market, as well as the cost of the effort” are too tough to consistently overcome.

Your Takeaway

So far, we have assessed some of the investment foes you face. The good news is, there is a way to invest that enables you to nimbly sidestep rather than face such formidable foes, and simply let the market do what it does best on your behalf. In our next installment, we’ll begin to introduce you to the strategies involved, and your many financial friends. First up, an exploration of what some have called the closest you’ll find to an investment free lunch: Diversification.