Welcome to the next installment in our Evidence-Based Investment Insights series: The Siren Song of Daily Market Pricing.

In our last piece, “Group Intelligence and the Market,” we explored how group intelligence governs relatively efficient markets (as well as jelly bean jars) in an imperfect world. Today, let’s look at how prices are set moving forward. This, too, helps us understand how to play with rather than against the wisdom of the market, as you seek to buy low and sell high.

News, Inglorious News

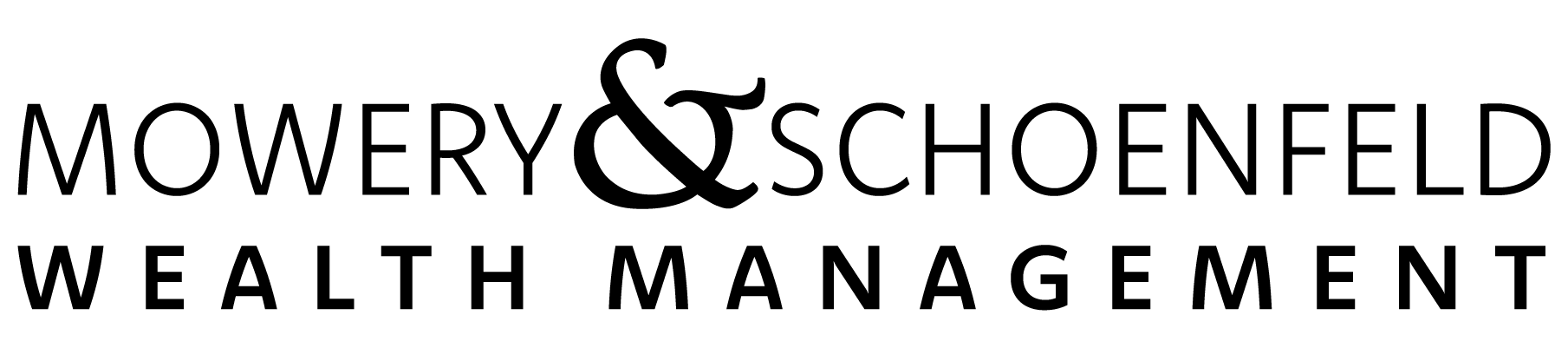

What causes market prices to change? It begins with the never-ending stream of news informing us of the good, bad, and ugly events taking place. For example, when there are reports that a fungicide is attacking Florida trees, orange juice futures may soar, as the market predicts that there’s going to be less supply than demand.

“Orange juice futures surge to record on fungicide fears” −Reuters, January 10, 2012

Prices adjust when unexpected events alter the market’s view of the future.

But what does this mean to you and your investment portfolio? Should you buy, sell, or hold tight? Before the news tempts you to jump into or flee from breaking trends, it’s critical to be aware of the evidence that tells us the most important thing of all: You cannot expect to consistently improve your outcomes by reacting to breaking news.

There is not much you can do in reaction to breaking news. There are two principles to bear in mind here.

Great Expectations

First, it’s not the news itself; it’s whether we saw it coming. When a security’s price changes, it is rarely because something good or bad has happened. It is whether the piece of good or bad news is better or worse than expected. For example, if the aforementioned orange tree disease is continuing to spread, pricing changes may be minimal; everyone was already expecting doom and gloom. On the other hand, if a new fungicidal treatment is released, prices may change dramatically in reaction to the unexpected resolution.

Thus, it’s not just news, but unexpected news that alters future pricing. By definition, the unexpected is impossible to predict, as is how dramatically (or not) the market will respond to it. Once again, group intelligence gets in the way of those who might still believe they can outwit others by consistently forecasting future prices.

The Barn Door Principle

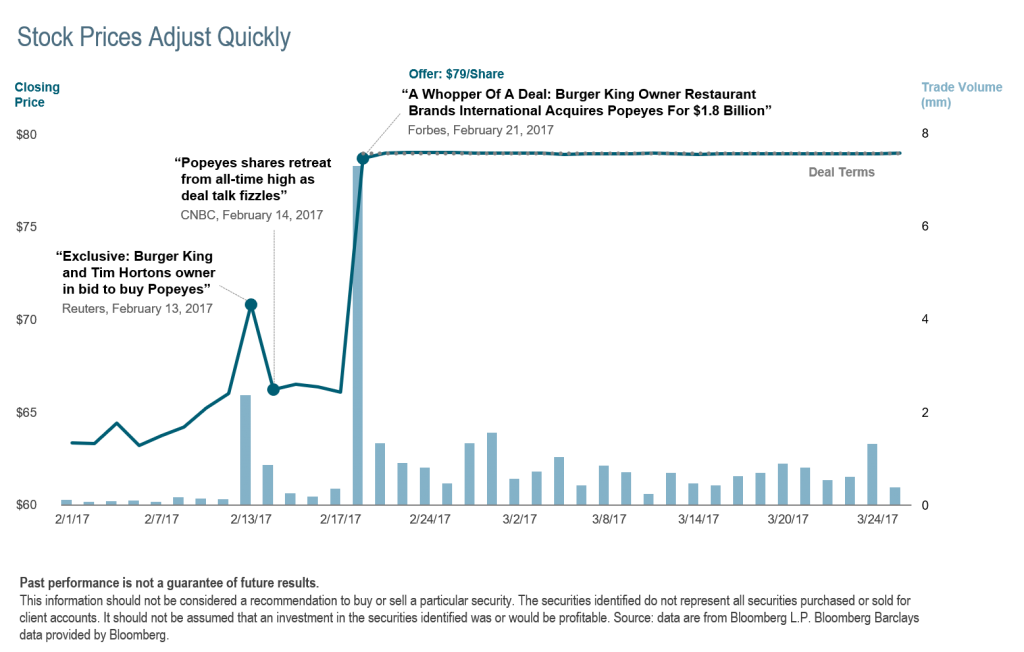

The second reason to consider breaking news irrelevant to your investing is what we’ll call “The Barn Door Principle.” By the time you hear the news, the market already has incorporated it into existing prices, well ahead of your ability to do anything about it. The proverbial horses have already galloped past your open trading door.

This is especially so in today’s micro-second electronic trading world. In his article, “The impact of news events on market prices,” financial author Larry Swedroe explored how fast global markets respond to breaking news. Pointing to evidence from a number of studies among several developed markets, the universal response was nearly instantaneous price-setting during the first handful of post-announcement trades. In the U.S. markets, it was even faster than that.

Popeyes Louisiana Kitchen stock price from merger announcement until completion

In other words, unless you happen to be among the very first to respond to breaking news (competing against automated traders who often respond in fractions of milliseconds), you’re setting yourself up to buy higher or sell lower than those who already have set new prices based on the news. This is exactly the opposite of your goal.

Your Takeaway

Rather than trying to play an expensive game based on ever-changing information and cut-throat competition over which you have no control, a preferred way to position your life savings is according to a number of market factors that you can better expect to manage in your favor. In future Evidence-Based Investment Insights, we’ll introduce these factors to you.

But first, you may be wondering: Even if you aren’t personally up to the challenge of competing against the market, you may think you can select a pinch-hitting expert to compete for you. Next up, we’ll explore the strikes against that tactic as well