Welcome to the next installment in our Evidence-Based Investment Insights series: "Get Along, Little Market."

In our last piece, “Managing Market Risk,” we described how diversification plays a key role in minimizing unnecessary risks and helping you better manage those that remain. Today, we’ll cover an additional benefit to be gained from diversification: a smoother ride toward your goals.

Diversifying for a Smoother Ride

Like a bucking bronco, near-term market returns are characterized more by periods of wild volatility than a steady trot. Diversification helps you tame the beast. As any rider knows, it does not matter how high you can jump if you fall out of the saddle. High or low, you will be left in the dust.

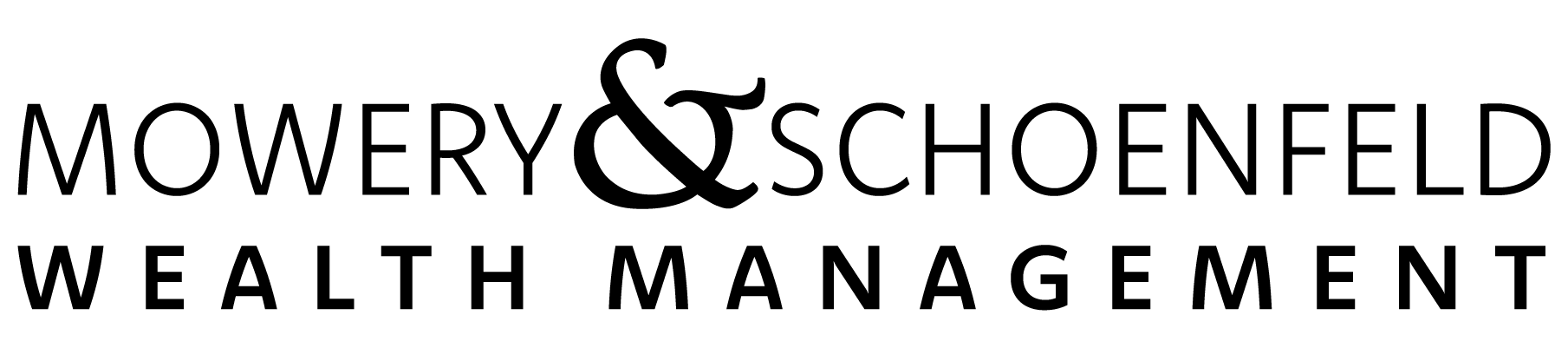

Diversification is shown to help minimize the leaps and dives you must endure to achieve your expected returns. Imagine several rough-and-tumble, growing investment securities. Individually, each represents a bumpy ride. Bundled together, the upward trend remains, but the volatility along the way can be dampened.

A well-diversified portfolio can provide the opportunity for a more stable outcome than a single security.

If you would like to see data-driven illustrations of how this works, check out “How to diversify your investments,” by financial author Larry Swedroe, or “When boring is good investing,” by financial author Craig L. Israelsen.

Covering the Market

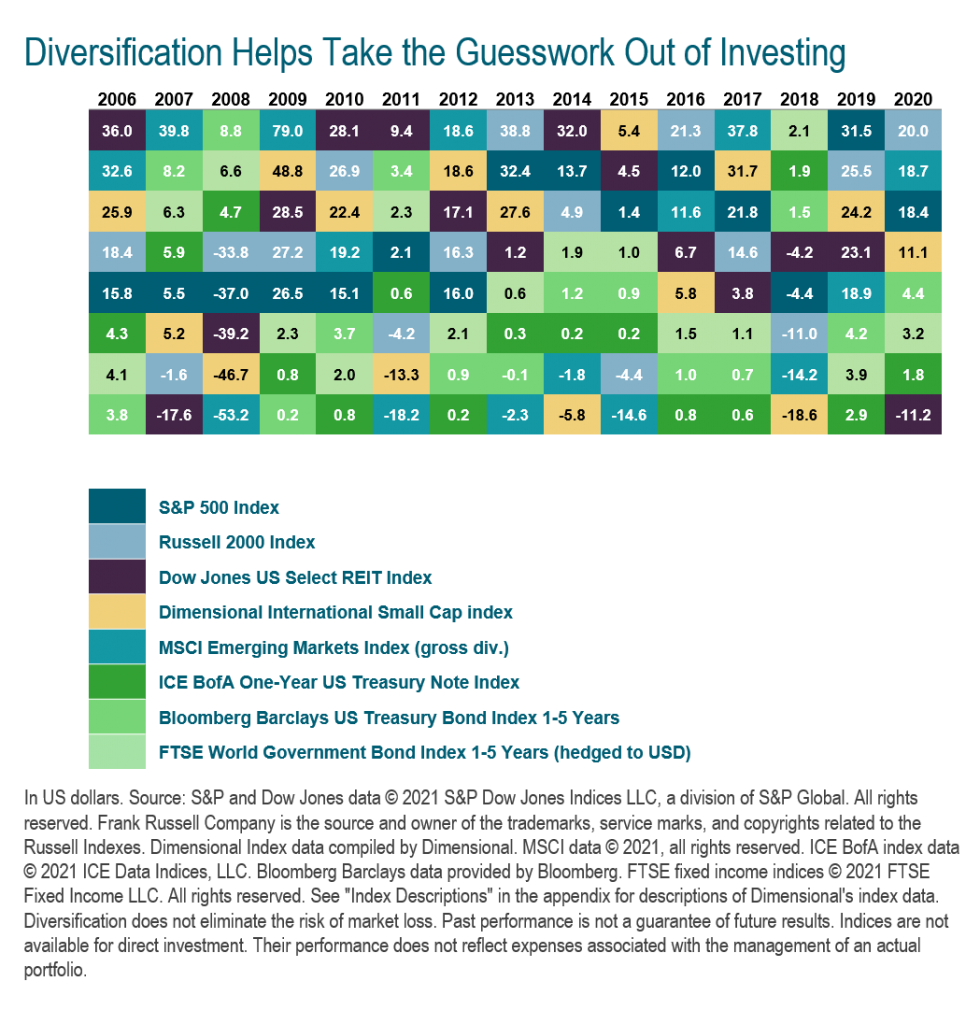

A key reason diversification works is related to how different parts of the market, or components, respond to price-changing events. When one type of investment may zig due to particular news, another may zag. Instead of trying to move in and out of favored components, the goal is to remain diversified across a wide variety of them. This increases the odds that, when some of your holdings are underperforming, others will outperform or at least hold their own.

The results of diversification are not perfectly predictable. But positioning yourself with a blanket of coverage for capturing market returns where and when they occur goes a long way toward replacing guesswork.

The Crazy Quilt Chart is a classic illustration of this concept. This color-coded layout shows which markets were the winners and losers in past years. It is clear that the only discernible pattern is that there is none. If you can predict how each column of best and worst performers will stack up in years to come, your psychic powers are greater than ours.

You never know which markets will outperform from year to year. By holding a globally diversified portfolio, investors are positioned to capture returns wherever they occur.

Your Takeaway

Diversification offers you wide, manageable exposure to the market’s long-term expected returns and a smoother expected ride along the way. Perhaps most importantly, it eliminates the need to try to forecast future market movements, which helps to reduce doubt.

So far in our series of Evidence-Based Investment Insights, we’ve introduced some of the challenges investors face in efficient markets and how to overcome many of them with a structured, well-diversified portfolio. Next up, we’ll pop open the hood and begin to take a closer look at some of the mechanics of solid portfolio construction.