Welcome to the next installment in our Evidence-Based Investment Insights series: "Managing Market Risk."

In our last piece, “The Full-Meal Deal of Diversification,” we described how effective diversification means more than just holding a large number of accounts or securities. It also calls for efficient, low-cost exposure to a variety of capital markets from around the globe. Today, we’ll expand on the benefits of diversification, beginning with its ability to help you better manage investment risks.

There's Risk, and Then There's Risk

Before we even have words to describe it, most of us learn about risk when we tumble into the coffee table. Investment risks are not as straightforward. It is important to recognize two different kinds of risks: avoidable, concentrated risks and unavoidable market-related risks.

Avoidable Concentrated Risks

Concentrated risks are the ones that wreak targeted havoc on particular stocks, bonds or sectors. Even in a bull market, one company can experience an industrial accident, causing its stock to plummet. A municipality can default on a bond even when the wider economy is thriving. A natural disaster can strike an industry or region while the rest of the world thrives.

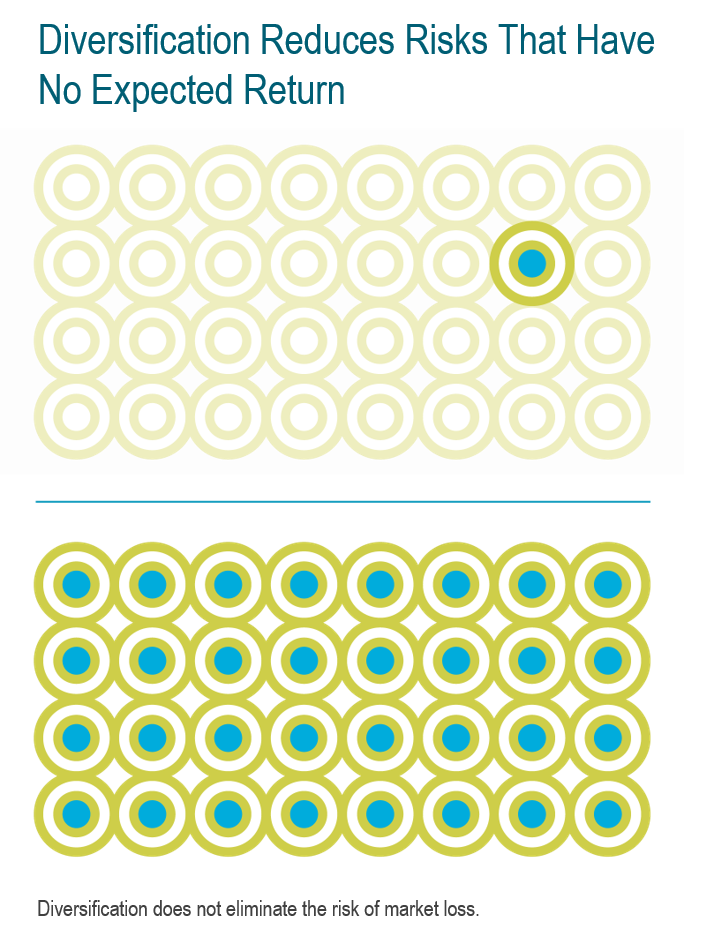

In the science of investing, concentrated risks are considered avoidable. Bad luck still happens, but you can minimize its impact on your investments by diversifying your holdings widely and globally. When you are well diversified, if some of your holdings are affected by a concentrated risk, you are better positioned to offset the damage done with plenty of other, unaffected holdings.

Concentrating in one stock exposes you to unnecessary risks.

Concentrating in one stock exposes you to unnecessary risks.

Diversification reduces the impact of any one company’s performance on your wealth.

Unavoidable Market-Related Risks

If concentrated risks are like bolts of lightning, market-related risks are encompassing downpours in which everyone gets wet. They are the persistent risks that apply to large swaths of the market. At their highest level, they are the ones you face by investing in capital markets in any way, shape or form.

Risks and Expected Rewards

Hearkening back to our past conversations on group intelligence, the market as a whole knows the differences between avoidable and unavoidable investment risks. Heeding this wisdom guides us in how to manage our own investing with a sensible, evidence-based approach.

- Managing concentrated risks – If you try to beat the market by chasing particular stocks or sectors, you are exposing yourself to higher concentrated risks that could have been avoided with diversification. As such, you cannot expect to be consistently rewarded with premium returns for taking on concentrated risks.

- Managing market-related risks – Every investor faces market risks that cannot be “diversified away.” Those who stay invested when a market’s risks are on the rise can expect to eventually be compensated for their steely resolve with higher returns. That’s why you want to take on no more market risk than is personally necessary. Diversification becomes a “dial” for setting the right volume of market-risk exposure for your individual goals.

Your Takeaway

Whether we are talking about concentrated or market-related risks, diversification plays a key role. Diversification is vital for avoiding concentrated risks. In managing market risks, it helps you adjust your desired risk exposure to reflect your personal investing goals. It also helps minimize the total risk you must accept as you seek to maximize expected returns.

In our next piece, we will address another powerful benefit of diversification: smoothing out the ride along the way.