Welcome to the twelfth installment in our Evidence-Based Investment Insights series: The Human Factor

In our last piece, “Exploring New Market Factors” we wrapped up our conversation about how to take advantage of different factors within a disciplined investment strategy. We turn now to the final and arguably most significant factor in your evidence-based investment strategy: the human factor. We will consider how your own impulsive reactions to market events can easily outweigh any other market challenges you face.

Exploring the Human Factor

Despite our knowledge of efficient capital markets and the evidence guiding decisions … we are still human. Despite being rational and educated, emotions can lead us to make irrational choices.

Rapid reflexes often serve us well. Our prehistoric ancestors depended on snap decisions when responding to predator and prey. Today, our child’s cry may still bring us running without pause to think.

But in finance, the coolest heads prevail. If left unchecked, your brain signals can trick you into believing you are making entirely rational decisions when you are in fact being overpowered by “survival of the fittest” reactions.

Put another way by neurologist and financial advisor William J. Bernstein, MD, PhD, “Human nature turns out to be a virtual Petrie dish of financially pathologic behavior.” [Source]

Behavioral Finance, Human Finance

To study the relationships between our heads and our financial health, we turn to the study of behavioral finance. In other words: What happens when we stir up that Petrie dish of financial pathogens?

Wall Street Journal columnist Jason Zweig’s “Your Money and Your Brain” describes both our behaviors themselves as well as what is driving them anatomically. For example:

- When markets tumble – Your brain’s amygdala floods your bloodstream with corticosterone. Fear clutches at your stomach and every instinct points the needle to “Sell!”

- When markets unexpectedly soar – Your brain’s reflexive nucleus accumbens fires up within the nether regions of your frontal lobe. Greed grabs you by the collar, convincing you that you had best act soon if you want to seize the day. “Buy!”

An Advisor’s Greatest Role: Managing the Human Factor

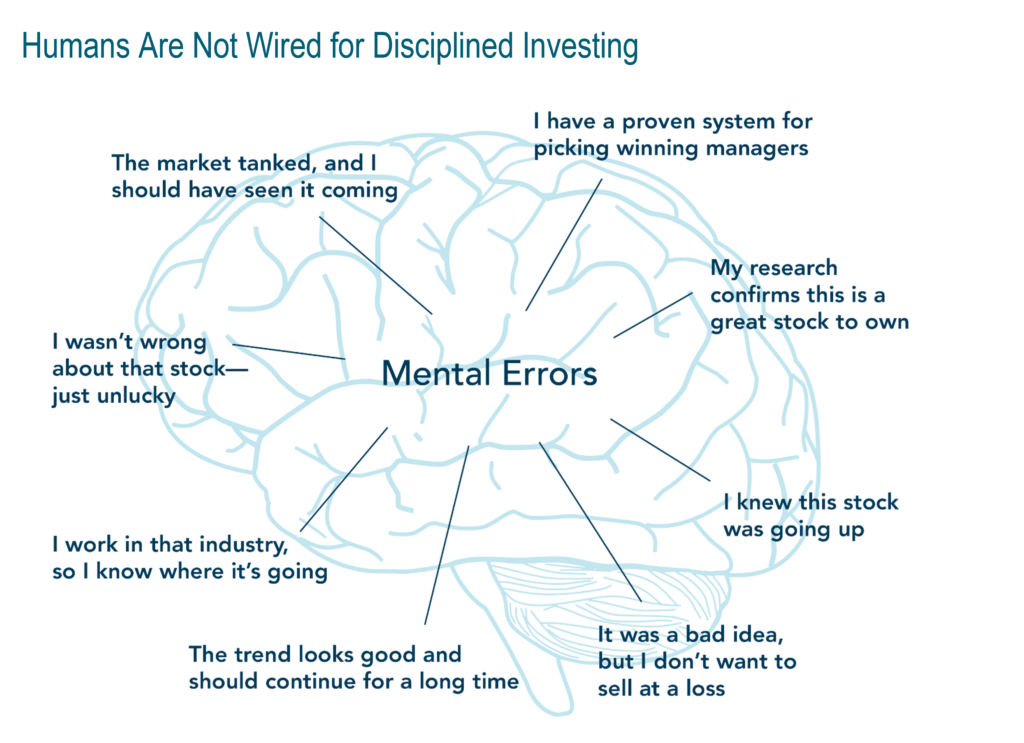

In addition to market-timing instincts, the human brain may fall victim to other biases. To name a few, there is confirmation bias, hindsight bias, recency, overconfidence, loss aversion, sunken costs and herd mentality.

When people follow their natural instincts, they tend to apply faulty reasoning to investing.

Your Takeaway

Managing the human factor in investing is another way an evidence-based financial practitioner can add value. Zweig observes, “You will get the best results when you harness your emotions, not when you strangle them.” It is our job to spot and reveal these biases, preventing them from doing any financial harm.

In our next piece, we will explore some of the more potent behavioral foibles investors face.