Welcome to the eleventh installment in our Evidence-Based Investment Insights series: "Exploring New Market Factors"

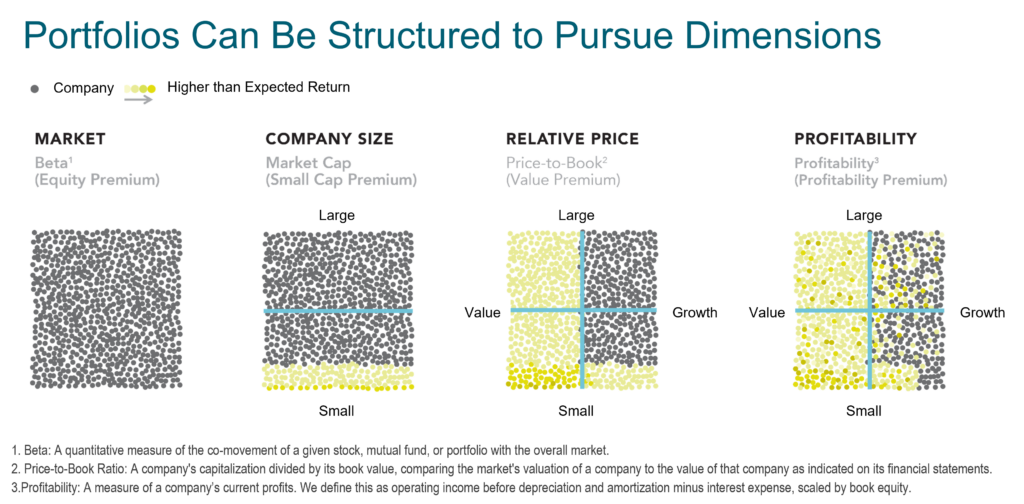

In our last piece, “Your Evidence-Based Portfolio,” we introduced three key stock market factors (equity, value and small-cap) plus a couple more for bonds (term and credit) that have formed a backbone for evidence-based portfolio construction. Join us today for a closer look at some of the newer factors research has uncovered, as well as their potential caveats.

As Eugene Fama explained, “You should use market data to understand markets better, not to say this or that hypothesis is literally true or false. No model is ever strictly true. The real criterion should be: Do I know more about markets when I'm finished than I did when I started?”

Through analysis and research, additional market factors were identified with the potential for premium results. These premiums may result from a combination of accepting added market risk, avoiding behavioral traps and checking your impulses.

Two of the more prominent factors leading to potential premiums are profitability and momentum:

- The Profitability Factor – Highly profitable companies have delivered premium returns over low-profitability companies.

- The Momentum Factor – Stocks that have done well or poorly in the recent past tend to continue to do the same.

A Closer Look at Newer Factors

Before we get ahead of ourselves, we should recognize a few caveats.

- Wet Paint Warning – Our ability to isolate and analyze the profitability and momentum factors is fairly recent. As the ink dries on the research papers, we are still assessing their staying power.

- Cost Versus Reward – Just because a factor exists in theory, does not mean it can be universally applied. We must be able to weigh the expected premium against its potential risk or cost.

- Dueling Factors – Sometimes it can be difficult to build one factor into a portfolio without sacrificing another. We must carefully consider benefits and tradeoffs at the fund level as well as for your individual goals.

Opinions vary on when, how or even if profitability, momentum and other newer potential factors should play a role in constructing your portfolio. As Fama has expressed, “There’s one robust new idea in finance that has investment implications maybe every 10 or 15 years, but there’s a marketing idea every week.”

We are here to walk you through our approach. To assess what makes sense for your portfolio, we will explore how to think about investment information.

Investors can pursue available market returns through a low-cost, well-diversified portfolio that targets these factors.

Investment Information: A Double-Edged Sword

As time marches on, relentless curiosity from scholars and practitioners alike is essential to evidence-based investment theory and application.

We must continue to base our approach on evidence. But one glance at daily headlines reveals a never-ending stream of ideas from competing, often conflicting voices of authority. While being informed is helpful, information overload can do as much harm as good. Even when the news is solid, hyperactive reaction can strip away all the advantages of an enlightened investment approach.

How do you know what to ignore? This is where an evidence-based advisor relationship is critical to your wealth and financial wellbeing.

Your Takeaway

By considering each new potential factor according to strict guidelines, we isolate new evidence-based insights from the considerably larger piles of misleading misinformation. Next, we turn to a factor we have mentioned but have yet to explore, even though it may be the most influential one of all: you and your financial behaviors.