Welcome to the next installment in our Evidence-Based Investment Insights series: "Your Evidence-Based Portfolio."

In our last piece, “The Essence of Evidence-Based Investing” we explored what we mean by “evidence-based investing.” Grounding your investment strategy in a rational methodology strengthens your ability to stay on course toward your financial goals, as we:

Assess the capacity of existing factors to aid in optimally investing and offer diversification benefits

Understand why such factors exist and effectively apply them

Explore additional factors that may compliment our structured approach

Assessing the Evidence (So Far)

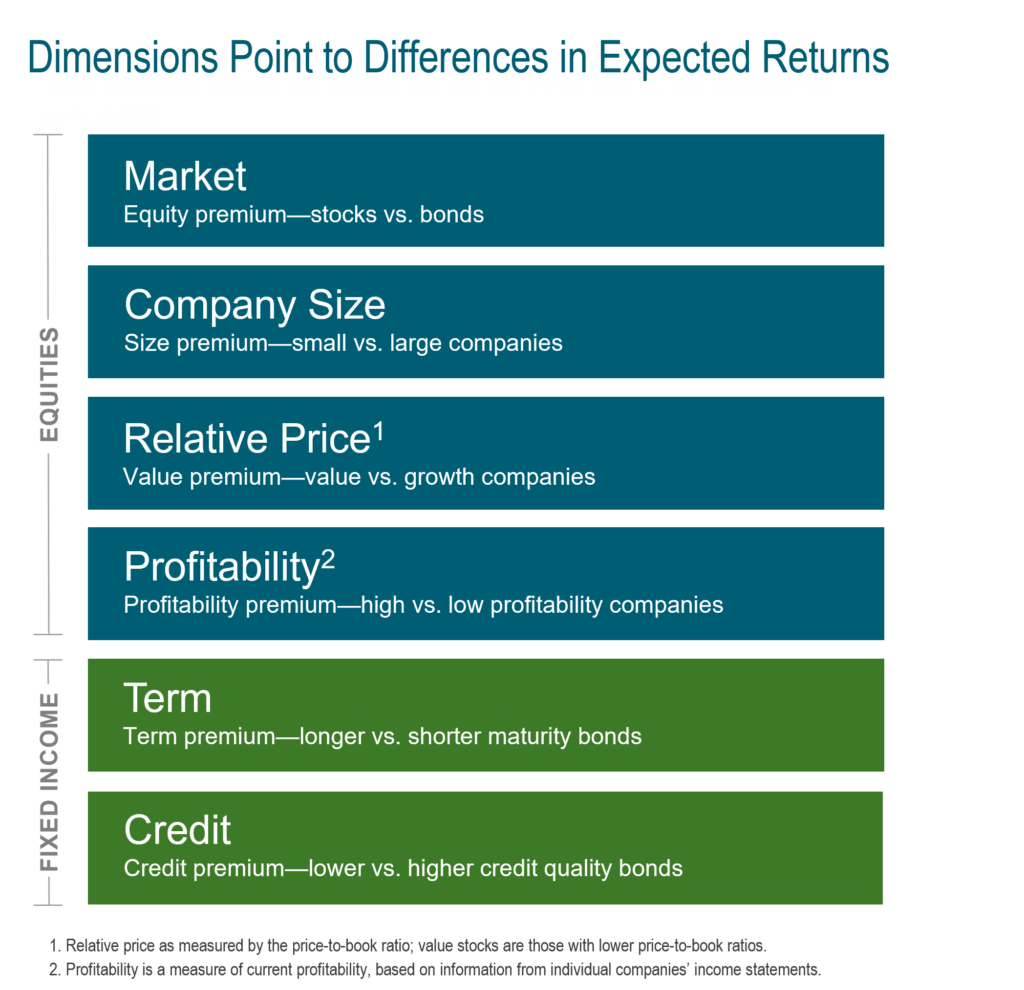

Long-term studies have identified three stock market factors that are the backbone of an evidence-based portfolio:

- The equity premium – Stocks (equities) have returned more than bonds (fixed income), as we described in “The Business of Investing”

- The small-cap premium – Small-company stocks have returned more than large-company stocks, although recent analysis suggests this factor may require additional dissection to isolate its essential premium.

- The value premium – Value companies (with lower ratios between their stock price and various business metrics such as company earnings, sales and/or cash flow) have returned more than growth companies (with higher such ratios). These are stocks that are either undervalued or more fairly valued by the market, compared with their growth stock counterparts.

This trio of factors was described in the Fama-French Three-Factor Model we discussed in “The Essence of Evidence-Based Investing.” Similarly, there are two primary factors driving fixed income (bond) returns:

- Term premium – Long-term bonds have returned more than bonds that come due quickly.

- Credit premium – Bonds with lower credit ratings (such as “junk” bonds) have returned more than bonds with higher credit ratings (such as U.S. treasury bonds).

Academic research has identified these dimensions, which are well documented in markets around the world and across different time periods. Stay tuned to learn more about the "new" factor of profitability premium.

Understanding the Evidence

We strive to determine not only that various return factors exist, but why they exist. This helps us determine whether a factor is likely to persist, so we can build it into a long-term portfolio.

Explanations for why persistent factors linger usually fall into two broad categories: risk-related and/or behavioral.

A Tale of Risks and Expected Rewards

Premium returns are often explained by accepting market-related risks (the kind that cannot be diversified away) in exchange for expected reward.

For example, value stocks are riskier than growth stocks. In “Value Premium Lives!” financial author Larry Swedroe explains: “Among the risk-based explanations for the premium are that value stocks contain a distress (default) factor, have more irreversible capital, have higher volatility of earnings and dividends, are much riskier than growth stocks in bad economic times, have higher uncertainty of cash flow, and … are more sensitive to bad economic news.”

A Tale of Behavioral Instincts

Our basic survival instincts often play against otherwise well-reasoned financial decisions. As such, the market may favor those who are better at overcoming their impulsive reactions to breaking news. Stay tuned for us to explore the fascinating field of behavioral finance in more detail, as this “human factor” contributes significantly to your ultimate success or failure as an evidence-based investor.

Your Takeaway

Factors that figure into market returns may result from added risk, checking behavioral temptations, or a mix of both. Regardless, existing and unfolding inquiry on market return factors continues to hone our strategies for most effectively capturing expected returns according to your personal goals. The same inquiry continues to identify other promising factors that may help us augment our already strong, evidence-based approach to investing. We will turn to these next.