Trusts are an important part of estate and tax planning, helping you keep control over your money and protect the wealth you’ve spent years building. But before choosing the right strategy, you should understand how trusts are taxed, how to fund them, what to consider when selecting a trustee, and some common mistakes that can derail your plan.

Consider these tax rules, funding steps, and pitfalls to ensure your trust works according to your wishes.

Distribution vs. accumulation and the impact on taxes

Every year, a trustee must decide whether it makes more sense to distribute income to beneficiaries or to accumulate the income inside the trust. That decision matters because of DNI, Distributable Net Income, or the amount of income the IRS allows a trust to “pass out” to beneficiaries for tax purposes.

If the trust distributes income, it is taxed to the beneficiaries, who usually have lower tax rates. If the trust keeps the income, the trust pays tax at its own rates, which quickly becomes high. This creates tax drag, or more tax being paid than necessary, which eats into long‑term growth.

Taxes 101 for trusts

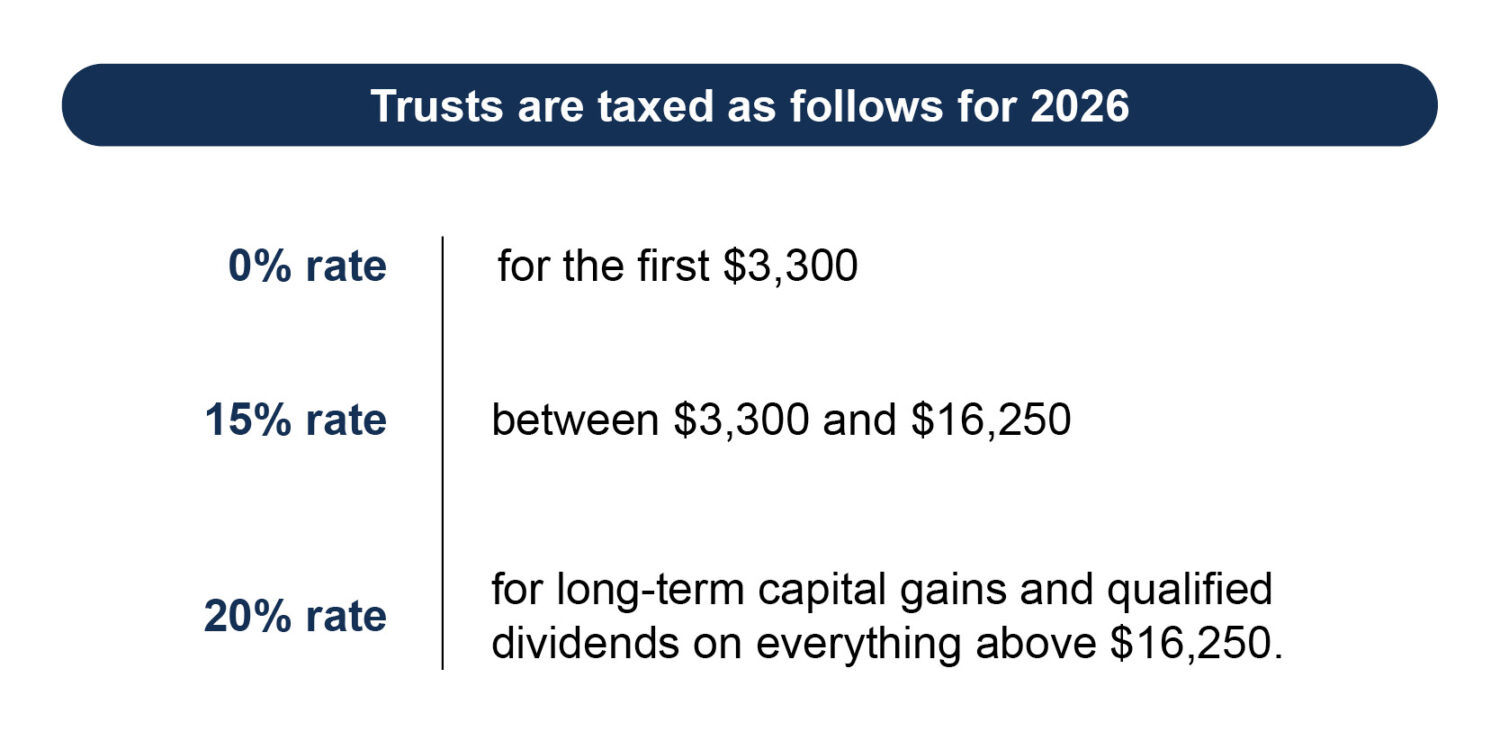

The top ordinary tax rate stayed at 37% for 2026, but trusts reach this top bracket quickly because they face compressed tax brackets, hitting the top rates at lower income levels. That means the income that accumulates inside the trust triggers a much higher tax sooner than it would for individuals, which don’t start hitting the top brackets until well into six figures. This is even true for preferential rate items such as long-term capital gains and qualified dividends, which are taxed as follows for 2026

- 0% rate for the first $3,300

- 15% rate between $3,300 and $16,250.

- 20% rate for long-term capital gains and qualified dividends on everything above $16,250.

Estimated taxes

Trusts typically pay estimated tax if both of the following are true:

- The trust expects to owe at least $1,000 after withholding and credits.

- Withholding and credits are less than 90% of 2026 tax or 100% of 2025 tax. (This becomes 100% if 2025 adjusted gross income, or AGI, is above $150,000 and not primarily from farming or fishing.)

There are some exceptions to this. For example, estates or domestic trusts that filed a full-year return with a zero 2025 liability don’t need to make 2026 estimated payments.

A fiduciary can elect to treat part of the trust’s estimated tax payments as if beneficiaries paid them using Form 1041-T if filed within 65 days after the end of the trust’s tax year. This can help beneficiaries meet their own estimated tax requirements when taxable income is distributed by the trust.

Net investment income tax (NIIT)

Undistributed investment income can trigger an extra 3.8% tax, except for fully charitable trusts. A 3.8% tax is applied to the lesser of either undistributed net investment income or AGI above the top trust bracket threshold, which is $16,000 for tax years beginning after 2025.

Funding and titling

Funding a trust means transferring ownership of your assets, including properties and financial accounts, into the trust for the trust to manage and distribute them according to your estate plan. The funding step is essential because without it, your trust isn’t actually governing them, so they may still have to go through probate — what you were trying to avoid.

Start by setting up a proper trust as part of your estate plan by choosing the trust type that works best for you and your goals. Next, determine your assets and gather documentation for each one.

You'll then open a trust account to hold your cash and investments under the name of your trust and transfer ownership of your other assets into the trust. For your real estate, that entails updating the deed to the trust’s name and recording the deed in your county. Quitclaim Deeds or Trust Transfer Deeds are often used to transfer real estate to a trust. Business interests can be transferred via Assignment of Interest if it’s an LLC or partnership or Assignment of Stock if it’s corporate stock.

You’ll also need to retitle your bank accounts to the trust. To show that the trust holds any of your personal property, like jewelry or furniture, you can work with your attorney to draft a general transfer document to reflect that, sign it, and keep the document with the trust records.

Be sure to coordinate with banks, custodians, and insurers, too, as you complete the funding and retitling process. Banks could have different requirements or forms for how to transfer the accounts to the trust. Insurance policies for real estate often cover property transferred to a trust, but check with the insurer to see if you need to do anything else.

Choosing trustees

When deciding on trustees, it’s crucial to understand the differences between an individual vs. a corporate trustee and consider which will offer you more advantages.

Individual trustees are often close friends or family members. Because they usually aren’t compensated for their role, appointing an individual trustee is not expensive. On the other hand, individual trustees might not be well-versed in financial management, and there could be a conflict of interest if they are also a beneficiary. Another factor to remember is succession planning and transferring to a new trustee in case the trustee dies.

A corporate trustee offers more protections than an individual trustee because they are legal entities and have detailed records, processes, and compliance rules. A corporate trustee also offers the benefit of being impartial, which can help the family maintain unity and peace during an emotional time after the grantor’s death.

Corporate trustees bring some helpful benefits: They offer limited liability, make it easier to keep assets separate, provide extra protection for your assets, help ensure smooth transitions when trustees change, and can handle a lot of the administrative tasks for you.

You can also choose to name a trust protector, or a person or third party who supervises the actions of the trustee to make sure they align with the best interests of the beneficiaries. When you name one, you outline their role and powers, which could include removing trustees, changing the trust's terms, and more. Adding a trust protector to your trust will come with increased costs.

Mistakes to avoid

Avoid these common pitfalls when setting up your trust to ensure your estate plan functions smoothly and your assets are protected:

- Not funding the trust: After establishing your trust, make sure to transfer ownership of your assets, such as real estate, bank accounts, and investments, into the trust. Failing to do so means those assets may still need to go through probate, which can be expensive and time consuming.

- Overlooking trust tax residency: The jurisdiction, or situs, of your trust determines which tax laws apply. Carefully choose the appropriate jurisdiction to optimize your tax situation and avoid unexpected taxes or compliance issues.

- Failing to keep trust documents updated: As your life circumstances and laws change, review and revise your trust documents regularly. This helps ensure your wishes are honored and your beneficiaries taken care of. Outdated documents can lead to results you didn't want, like assets going to people you no longer wish to include, excluding new family members, or missing out on new tax exemptions.

- Not clarifying provisions: Ambiguous language in your trust can cause confusion, disputes, or even litigation among family members. Work with an attorney to make sure all provisions are clear and reflect your intentions.

- Using the wrong trust type for business interests: If you own S-corporation stock, be aware that only certain trust types, like a Qualified Subchapter S Trust (QSST) or an Electing Small Business Trust (ESBT), can hold S‑corp shares without jeopardizing the company’s S‑corp status. Consult with experts before transferring business interests into your trust.

- Omitting HEMS provisions: Including language for health, education, maintenance, and support (HEMS) gives trustees flexibility to address beneficiaries’ needs. Without this, trustees may be limited in how they can distribute assets, potentially leaving beneficiaries without support.

- Cash poor, asset rich: The wrong asset mix in your trust can create liquidity issues for beneficiaries or tax obligations, forcing the premature sale of valuable assets. Work with your financial advisor and attorney to ensure liquidity issues don’t derail your trust's estate and wealth planning goals.

By being proactive when setting up your trust, you can help minimize taxes and prevent unnecessary complications for your loved ones.

How our firm helps

Let Mowery & Schoenfeld help you navigate trust planning, maximize your tax advantages, and safeguard your assets. Our team brings together deep tax knowledge and comprehensive wealth management, allowing us to deliver tailored strategies that fit your needs. Reach out to explore which trust solutions are right for you. Learn more about estate, gift, and trust planning services