As Bitcoin's latest moves monopolize the headlines, cryptocurrency fever is at its height. Before you start loading up on bitcoin or any other form of cryptocurrency, join us for a closer look at what you may be getting yourself into, in this three-part series:

Understanding cryptocurrency

Spending cryptocurrency

Trading in cryptocurrency

Our quick take? Cryptocurrency is interesting, full of promising possibilities, and considerable risk.

Before diving in, we want to understand the nature of the beast. Whether trading in for fun or profit, we advise against investing any more than you could afford to lose entirely. At this time, cryptocurrency remains more of a speculative venture than a disciplined investment.

A Brief History:

Unlike a dollar bill, cryptocurrency only exists as computer code. You cannot touch it or feel it. You cannot flip it, heads or tails. But you can spend it and trade it, and its uses continue to expand. There is also growing interest in trying to build and preserve wealth by trading in cryptocurrency. This is why it is occasionally referred to as “digital gold.”

Cryptocurrency vs. “Regular” Money

In comparing cryptocurrency to regulated fiat currency – or most countries’ legal tender – there are at least two components to consider: limiting supply and maintaining spending power.

- Limiting Supply: Central banks limit their currency’s supply without strangling its demand to regulate the value of that currency. For Bitcoin, supply is limited to a maximum of 21 million coins. While cryptocurrency proponents explain how supply and demand will be managed, some systems will undoubtedly be more effective than others at sustaining this delicate balance.

- Maintaining Spending Power: Neither fiat currency nor cryptocurrency are directly connected to the value of an underlying commodity like gold or silver. Thus, both must have another way to maintain their value in the face of inflation. In most countries, the nation’s central bank is in charge of keeping its fiat currency’s spending power relatively stable. Only the government can add or subtract from its supply of legal tender. For cryptocurrency, there is no central bank, or any other centralized repository or regulator. Stability is instead backed by its underlying blockchain.

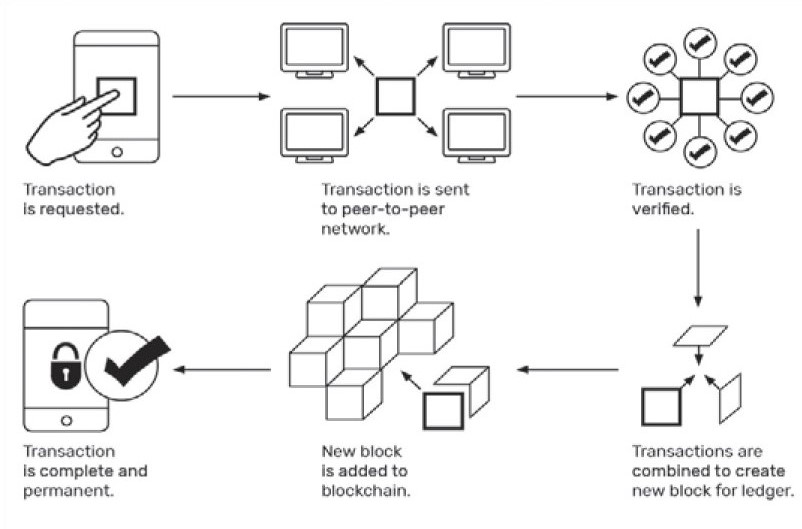

How do Bitcoin transactions work?

“This is the real breakthrough of blockchains: creating timely, bad-actor-proof consensus across all copies of a decentralized and distributed database. … Today, more than 40,000 computers are independently verifying every single bitcoin transaction.”

In other words, blockchains create a strong, yet globally decentralized check-and-balance system. The competition among thousands of users keeps everyone relatively honest, as any attempted “cheating” by cryptocurrency holders should be promptly detected.

Next Up: Spending Cryptocurrency

With this general introduction to cryptocurrency, we can move on to cover some of the ways people are using it, along with the challenges they encounter. Stay tuned for next week's article! In the meantime, do not hesitate to be in touch if we can answer additional questions.